There are several types of trading patterns. Patterns are observable price action that can be used to determine the future direction of a currency pair.

Patterns can help you decide whether a forex pair will continue to trend in a specific direction or reverse. You can use online trading chart patterns as a way to bolster your trading arsenal.

1. Continuation Patterns

A continuation pattern is a pattern that designates a consolidation in price action before the market continues to trend in a specific direction.

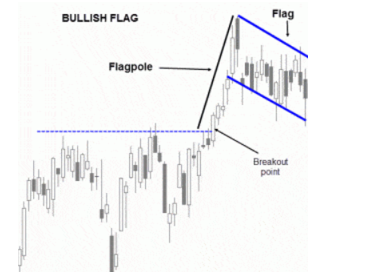

One of the most widely used trading chart patterns is the bull or bear flag chart pattern.

A bull flag trading pattern is one where prices break out of a range and form the pole of the flag.

Prices than consolidate and move sideways forming the flag itself. Prices are pausing as they move sideways before than begin to trend in the direction of the flag pole.

A bear flag trading pattern is similar to the bull flag except prices break down and then consolidate before beginning to trend lower again.

In addition to the bull and bear flag continuation trading patterns there are other trading patterns that designate a continuation. The wedge is very similar to the bull and bear flag.

Prices form a wedge before they continue in the direction of the breakout. All continuation patterns have similar attributes. Prices break in a direction and then consolidate before the trend resumes.

2. Reversal Patterns

There are several different types of reversal patterns. These are patterns that form either a top or bottom before changing direction. The head and shoulder, the double or triple top or bottom are some of the more commonly used reversal patterns.

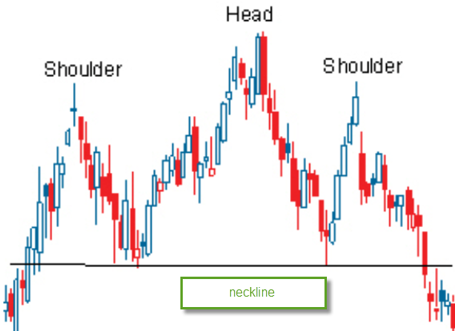

3. The Head and Shoulder Pattern

The head and shoulder reversal pattern, comes at the end of a trend. Prices surge to new highs, but find resistance as they form the left shoulders. Prices form a continuation pattern and begin to rally to fresh new highs before they find resistance.

Generally, prices reverse to support which is consistent with support near the left shoulder. This is what is referred to as the neckline. The head is now formed, but traders once again make an attempt to push prices to new highs. The right shoulder is formed as upward momentum stalls.

Prices then begin to fall and when they break through the neckline, volume begins to accelerate. The head and shoulder reversal pattern is complete with a close below the neckline.

4. Double or Triple Top and Bottom

Prices will form a double or triple top which is another common reversal pattern. The tops will generally align in a row, as prices attempt to push through resistance but fail to generate traction.

The topping pattern forms once prices breakdown through the neckline of the top. A double or triple bottom is similar but forms a double u as opposed to am M pattern.

Summary

Continuation and reversal patterns are very common in forex trading. Continuation patterns are pauses that refresh.

A reversal pattern forms a top or bottom that leads to a reversal in price action.

If you are new to forex trading, you can check out other trading tips on Learnbonds.