ZuluTrade is a social trading platform that links investors and signal providers.

Signal providers are traders who have proved to be consistently profitable over a given period of time.

Leon Yohai is the creator of ZuluTrade and he registered it in 2007.

The thought behind ZuluTrade is to offer a platform in which traders globally can interact, share knowledge and connect their trading platforms.

Here is an unbiased ZuluTrade review.

Account Registration

Registration for a ZuluTrade account is free and traders have the option to either create a new account or to link an already existing trading account provided by other brokers.

ZuluTrade offers demo accounts which traders can utilize to experiment in different settings and trade with zero risks.

As soon as a trader or investor has identified a combination that suits their needs then they can proceed and open or link a live account.

Registering a live account is simple and straightforward. Upon visiting the ZuluTrade website, you shall click on the registration button.

Once you click and select the live account option, you will then select a supported broker from the list that you shall be provided.

Upon registration with the broker and funding your account, ZuluTrade will send your ZuluTrade account credentials to the registered email within 2 to 3 days.

Traders and investors have the option of linking their already existing accounts to ZuluTrade as long as the broker is supported by ZuluTrade.

It is important to note ZuluTrade supports more than 50 different brokers so there is a high chance that your broker is among those that are supported.

You can know if your broker account has been correctly linked to your ZuluTrade account by scrolling to the broker account setting tab and checking the account connection status; connected to broker means that the link has been properly done while disconnected means that the two platforms have not been properly linked.

If disconnected, simply enter your broker account numbers and broker MT4 master password and click connect.

List of ZuluTrade Supported Brokers

- Triple A Experts

- FXDD

- Dukascopy

- ADS Securities

- USG

- Traders Trust

- Matador Prime

- Start FX

- Top Forex

- Phnom Penh Securities

- AETOS Capital Group

- IC Markets

- Alfa Forex

- FXOpen

- InterTrader

- AxiTrader

- InstaForex

- Fidelis Capital Markets

- GDMFX

- ITRADER

- MFX

- Forex24

- NPBFX

- Titan FX

- Finpro

- SystemForex

- Pepperstone

- FXCM0

- Swissquote Bank

- Land-FX

- Vantage FX

- FirewoodFX

- PlatinaFx

Account Types

Traders or investors have two main live account types which are:

- Classic accounts

- Profit-sharing accounts

Classic accounts

Under this trading account, a trader has the ability to perform both copy trading and manual trades.

Traders will have the ability to create a portfolio, customize portfolio settings, close trades, update trading signals and customize advanced features.

Profit-sharing accounts

This account type is suitable for those seeking to utilize the copy trading feature only.

A trader or investor will simply identify a top performing signal provider, set up a fund protection amount and let the copy trading run.

In profit sharing accounts, a monthly performance fee of 20% is charged on all profits generated on your account.

ZuluTrade utilizes a system called High Water Mark (HWM) to calculate the amount of chargeable profit.

In other words, the performance fee will only be charged when profits exceed the monthly predetermined HWM level.

The fee WILL NOT be charged when losses have been made and when profits are below the predetermined HWM level.

Portfolio Settings

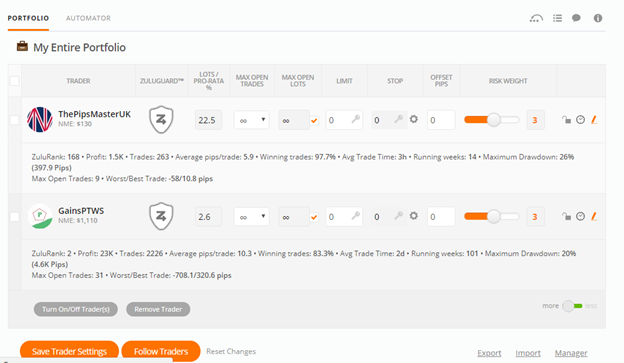

On the ZuluTrade platform, the portfolio settings allows you to view a brief description of the signal provider’s information such as ZuluRank, profits, trades, percentage winning trades, etc.

Also, it gives the trader or investor the ability to set settings in regards to the traders (signal providers) you are following.

The portfolio settings tab resembles the picture below.

Under this tab, a trader or investor will be able to setup:

- Risk meter bar; this sets the degree of capital that will be used in trades and is shown in percentage form. A higher percentage signifies a higher degree of risk.

- Choose your signal providers or traders; choosing traders will enable the auto trade feature and trades will be automatically copied in accordance to the signal providers’ trades.

- Activating ZuluGuard. ZuluGuard is a security feature that protects the investors’ capital. It works by monitoring the signal provider’s behavior and whenever a radical change occurs, ZuluGuard can either close all open trades under that trader, disable the trader or request you to replace the trader with a higher ranked trader.

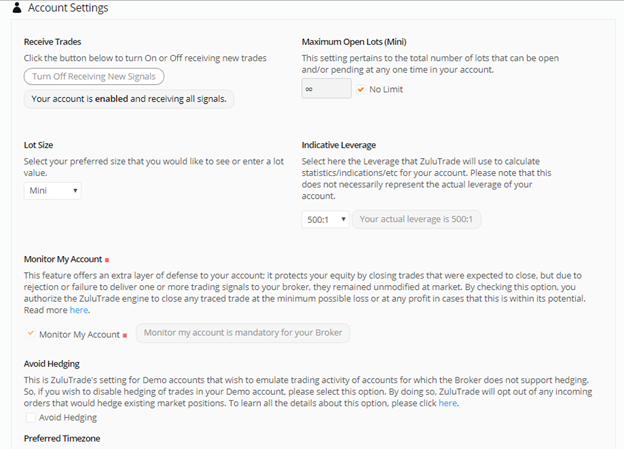

Account settings

On the ZuluTrade platform, under the account settings section, an investor or trader has the ability to custom set settings in accordance to his or her preference.

Here is an image of the the account settings section.

Some of the important settings are:

- Maximum open lots; this setting lets you set the maximum number of cumulative lots a signal provider can place in your account at one given time. You also have the option of selecting “no limits”.

- Maximum open trades or currency; this lets you set the maximum number of open trades of a specific currency pair.

- Limit and Safe limit; limit setting gives you the ability to set limits in terms of pips while the safe limit option compares your own personal limit to that set by the signal provider and the system automatically works with the lowest or safest limit.

- Trailing Stop; this setting lets you set a trailing stop for specific traders. Trailing stops do not need physical monitoring of the trades and once set, the stop loss levels will automatically be adjusted in accordance with your setting.

- Conditional Stop; this is a type of trailing stop loss that is normally activated when some certain conditions are met. For instance, you can set a trailing stop to be activated only when a trade is in a profit of 50 pips.

- Safe Stop; this option lets the system compare your stop loss levels including trailing stops with that of the signal provider and the system selects the lowest level. Example, if your stop loss is set at 50 pips and the signal provider’s stop loss is set at 25, the system will use 25 because it is lower.

Advantages of Using ZuluTrade

- Availability of a demo account allows traders and investors to test out signal providers without risking their own money.

- A wide variety of signal providers to pick from.

- Fair pricing- you’re only charged when you’re profitable.

- Availability of many regulated brokers.

- Ability to follow both forex and binary options signals.

- Availability of advanced risk management features.

Disadvantages of ZuluTrade

- Due to the fact that there are several signal providers available, it will take some research and time to get a signal provider that you’re comfortable with.

- Finding the right money management settings can be intimidating especially for novice traders.

Conclusion

As this ZuluTrade review has revealed, the company has given investors an opportunity to earn returns from the forex market without the need of being professional traders.

The advanced risk management and money management features make it easy for investors to set limits in regard to the amount of capital they have.

Since ZuluTrade is a social trading platform, novice traders have the opportunity to communicate with professional signal providers. By doing so, they get an opportunity to learn.