Choosing best forex broker for beginners is integral if you want to succeed in the business of trading currencies. A forex broker acts as the middleman that brings buyers and sellers together to carry out transactions in the foreign exchange market.

Brokers are agents that float the best price in the forex market for participants to use.

It is true that forex trading is a lucrative business. Because of its many advantages, many people are daily abandoning the traditional financial markets and channeling their investments in currency trading.

At the same time, an increased number of forex brokerage firms have sprung up and are enticing inexperienced traders using their large and glittering advertisements to invest their hard-earned cash with them.

Since the industry is littered by so many currency trading brokers of all types, to choose the best forex broker correctly can be a daunting task.

As such, on this website, we have reviewed and listed only the best forex brokers who have earned the industry’s reputation in quality service delivery and unmatched commitment at addressing the needs of their customers.

Here are 10 essential considerations you should bear in mind when you are looking for a top rated forex broker:

- Quality of customer service

- Industry regulation

- Diversity of account types

- Number of tradable instruments

- Competitive spreads

- Demo account availability

- High rate of order execution

- Diversity of customer service options

- Trustworthy deposit options

- Quality of the website

1. Assess the quality of customer service your best broker is providing

Because the online trading of currencies does not require you to walk into your broker’s office to place orders, it is important you choose a broker who is responsive, patient, and supportive at addressing any problems you may be having.

Some forex brokers are known to be very friendly and cooperative when you want to start trading with them, but abandon you soon after you have deposited money into your live account.

Like any other thing on this planet, brokers are not perfect. Therefore, you need a good forex broker who will be fast at addressing any issues you may be having at a future date.

2. Check if the top broker is certified with a regulating authority

The lucrative forex industry is full of fraudsters who are out to suck money from innocent traders.

However, there are numerous financial regulation agencies situated all over the world that aim to tame this fraudulent behaviors of forex brokers.

Therefore, to protect you from being a prey of the so-called online thieves, you should ascertain whether your preferred broker is registered by any of these regulatory bodies.

The most common ones are the U.S. Commodity Futures Trading Commission (CFTC), National Futures Association (NFA), Financial Services Authority (FSA), and the Australian Securities and Investment Commission (ASIC).

If any currency trading broker has not passed through the painstaking certification process offered by these regulatory bodies, then you should dissociate yourself from it.

Best forex brokers will maintain their industry reputation by making sure they have a certified license of operation.

Click here to read more on worldwide forex regulation.

3. Highly ranked forex brokers usually offer various account types for their customers

In the world of forex trading, everyone has his or her own tastes and preferences in trading. Therefore, the best forex brokers have tailor made different account types to suit the background and style of trading of their customers.

Even if an online currency trading broker provides only one type of account, it should be designed such that it can be customized easily to resonate well with the needs of its customers.

Worth mentioning, the account types should be as user friendly as much as possible.

4. How many tradable instruments does your preferred broker offer?

During these times of economic uncertainties, most investments are considered to be insecure. Therefore, you need to diversify your portfolio so as to cushion some of your investments in times of economic hardships.

In addition to currencies, quality forex brokers usually offer other tradable instruments such as commodities (crude oil, gold, copper etc), Contracts for Differences (CFDs), stocks, and others.

You should not agree to deposit your cash with brokerage firms that offer only one tradable instrument or some few others because you never know when it would be your rainy day.

5. Best forex brokers usually offer the most competitive spreads in the market

Spread, which is the difference between bid and ask price, is key in the business of online trading of currencies because it is the amount you are charged by your broker every time you place a trade on your trading platform, irrespective of whether you make profits or losses from the position.

Spreads are either fixed or variable. Fixed spreads do not change while variable spreads fluctuate depending on the conditions of the market.

It is preferable choose best forex broker with a fixed spread than a broker with a variable spread. This is because in very volatile market conditions, the stop loss orders may get hit if the spread provided by the broker increases by a large number.

6. Top rated forex brokers provide a demo (practice) account

Before you invest your hard-earned money in forex trading, you should experiment your trading style comprehensively using a demo account.

Although it has virtual money, demo account gives the real market conditions that will enable you to explore the strengths and weaknesses of your strategy for navigating the market without risking any of your cash.

As such, if you start trading using a demo account, you will boost your confidence, develop discipline, perfect your skills, and develop consistency when trading currencies.

Best forex trading brokers usually provide demo accounts on their websites for free. You should stay away from brokers who fail to offer this important tool, especially if you are an alien in the world of forex trading.

7. Best forex brokers have high rate of execution of orders

Since the values of currencies move very fast, brokers that do not offer instantaneous execution of orders may compromise your profits.

A common problem regarding execution of orders in currency trading is slippage. It takes place when your order is delayed and filled at a price different from what you expected.

Do you want to experience that? Therefore, you should think twice before depositing your money with a broker who has not invested in state-of-the-art technology in order execution.

8. Choosing best forex broker requires looking at customer service options

Upon signing up and opening a live account, reputable brokers normally assign to you a personal account manager. The role of the account manager is to answer all questions relating to trading or brokerage.

As a trader, sometimes you may need to communicate with your broker to troubleshoot some problems or to ask questions.

If you don’t have a personal account manager or if you want to ask questions before signing up, trustworthy forex brokers offer many customer service options.

Reputable brokers have various means through which one can communicate with them. Some of these ways include:

- Live chat

- Telephone number

- Call back requests

- Email support

- Skype support

9. Reputable brokers offer trustworthy deposit options

Reputable forex brokers should prompt you to verify your information before you proceed to deposit funds.

Verification of information means that you send your proof of identity.

This can be your national identity card, driver’s license or passport. Your proof of residency can be a recent utility bill as long as it shows your physical address and is not older than three months.

Upon account verification, a reputable broker should provide various means through which you can deposit your funds into your live account.

Some of these ways include:

- Credit or debit cards. Examples include; Visa, Mastercard, and UnionPay

- Electronic methods or e-wallets. Examples include; Skrill, PayPal, Neteller, Webmoney, perfectmoney etc.

- Bank wire transfers

10. Best forex brokers have quality websites

Website scrutiny refers to the thorough inspection of a website in order to identify flaws that may be made by non-reputable brokers.

Top-rated forex brokers spend a lot of money to have a good and flawless website, therefore, errors should be minimal, if any.

In this section, we will discuss how you can effectively inspect a website for errors.

- Grammatical errors

The most common mistakes made are grammatical errors. A few grammatical errors such as spelling mistakes may be accidental but if they occur on multiple occasions, that might be a sign of rushed work which is common for fraudulent brokers.

- Physical address verification

Reputable forex brokers should display their location details on their website.

You can use google maps to search and verify if such a physical address exists.

In addition to location details, reputable brokers have a well-documented FAQs tab. Information such as account types, deposit and withdrawal options, types of trading platforms and more should be easily accessible through the FAQs tab.

- Alexa ranking

To further scrutinize the broker’s website, you can use Alexa which is a site that shows you how popular a website is.

Reputable forex brokers should have a high popularity ranking. Please note that a broker can still be reputable and have a low Alexa rating.

This can be due to a number of things such as the website’s age.

- Languages options

Reputable forex brokers have a goal of attracting traders from all parts of the world and because of this, they offer several language options.

You should be skeptical if the broker you are interested in just offers one or two languages.

A Review of the Best Forex Trading Brokers

In this section, we will the best brokers you can choose for your trading.

1. EasyMarkets Broker Review

Click here to open an account with EasyMarkets.

Incorporated in 2001, EasyMarkets has been one of the biggest brokerage firms available to traders.

Previously known as easy-forex, EasyMarkets has a philosophy of being honest, transparent and simple for both experienced and novice traders.

Regulation

EasyMarkets is regulated by CySEC (Cyprus Securities and Exchange Commission) and ASIC (Australian Securities and Investments Commission).

Trading platforms

EasyMarkets has three main trading platforms which are:

- EasyMarkets MT4

- Easymarkets web platform

- Easymarkets app (available on android and iOS)

Trading products

On EasyMarkets best forex trading platform, you’ll be able to trade commodities, currencies, indices, options, and cryptocurrencies.

Trading account types

There are four main trading accounts available to traders.

These are:

- Super VIP

- VIP

- Premium

- Standard

The maximum leverage on all the above accounts is 1:400 for the MT4 platform and 1:200 for the web platform.

In addition to the above account types, EasyMarkets offers Islamic or sharia-compliant trading accounts for those of the Islamic faith.

Deposits and withdrawal

The minimum deposit amount depends on the account type.

The minimum deposit for a standard account is $100, minimum deposit for a premium account is $1000, that for a VIP account is $2000 and for super VIP is $10,000.

EasyMarkets does not charge a deposit or withdrawal fee.

There are several avenues through which you can fund and withdraw your account and they include:

- Visa

- Mastercard

- American Express

- Webmoney

- Giropay

- Neteller

- Skrill

- Fasapay

- UnionPay (China only)

Customer support

There are a number of ways in which you can talk to an EasyMarkets representative and they include:

- Email support

- Telephone support

- Live Chat

- Viber

- Facebook messenger

Restricted regions

EasyMarkets does not provide services to people in certain regions. Some of these regions include The United States of America, Ontario, Israel, Iran, and Sudan.

Languages

EasyMarkets is available in four main languages: English, Polish, Arabic, and Chinese.

Conclusion

EasyMarkets is a regulated and reputable brokerage firm that has been awarded multiple of times and has stood the test of time.

Both novice and experienced traders can rely on EasyMarkets to execute all their trades.

Protection from a negative balance is also a hailed change in the industry with all traders guaranteed no slippage to their open trades.

The only disadvantage of EasyMarkets is the limited number of languages available and a low maximum leverage when compared to other brokers in the industry.

You can read moe about EasyMarkets here.

2. InstaForex Broker Review

Click here to open an account with InstaForex.

Incorporated in 2007, InstaForex has become a popular forex broker and according to the InstaForex website, they have more than 7 million traders registered under them.

InstaForex offers demo accounts where novice and experienced traders can practice and test various strategies and systems till they are comfortable to trade with a real account.

License and regulation

InstaForex is regulated and licensed by cySEC and BVI FSC. Under cySEC it has a license number of 266/15 and under the BVI FSC (British Virgin Islands Financial Services Commission) InstaForex is registered under the license number SIBA/L/14/1082.

Trading platforms

InstaForex has three main best forex trading platforms:

- InstaForex MT4

- InstaForex webTrader

- InstaForex mobile available on IOS and Android

The trading platforms will give you access to trade 107 currency pairs, commodities, 200 CDFs among other assets.

Deposit and withdrawal

The minimum deposit amount is only 1 USD and InstaForex does not charge any deposit fee.

There are various ways in which one can deposit funds into a live account and these methods include:

- RBKMoney

- Qiwi

- Skrill

- Neteller

- Yandex Money

- Z payment

- Visa cards

- Mastercards

- Bank wire transfers

The duration of withdrawing funds varies depending on the above-mentioned deposit methods.

For instance, withdrawing funds via Qiwi, Skrill and Neteller would take between 1 and 7 hours only while withdrawing via bank transfers can take between 2 and 4 days.

The minimum amount you can withdraw is 1 USD with an exception of withdrawing via bank transfer being 300 USD.

There is no limit as to how much you can withdraw.

Customer support

InstaForex offers various ways in which you can communicate with them and these methods are:

- Request a callback

- Live Chat

- A physical visit to their offices

Languages

InstaForex offers its services in 27 different languages. Some of the major languages include English, Spanish, Italian, German, Arabic, Dutch, and French.

Conclusion

InstaForex is a great platform for both novice and experienced traders.

The availability of a demo account is great for strategy testing and gaining experience.

The availability of various deposit options is attractive to traders.

Additionally, the minimum deposit is just 1 USD. The short withdrawal period is also a great benefit that a trader will enjoy using InstaForex.

Traders have a choice among various leverage options, with the minimum leverage available being 1:1 and the maximum leverage is 1:1000.

InstaForex also offers a forex to novice traders as long as they create a live account and deposit a minimum of $100.

You can read more about Instaforex here.

3. ZuluTrade Review

Click here to open an account with ZuluTrade.

ZuluTrade was incorporated in 2007 and its main purpose is to enable traders to be able to share their skills or knowledge in regard to trading strategies and systems.

In addition to knowledge sharing, ZuluTrade allows traders to automatically copy trades even though their trading platforms or brokers may be different.

Under the platform, traders can communicate with one another by leaving feedback and comments.

Because of this, ZuluTrade can be considered to be a social trading platform.

How it works

Traders connect their already registered trading accounts with ZuluTrade then they display their results on a performance page.

Depending on the performance, investors or traders can follow or copy the strategies of high performing traders.

The traders who are followed are known as signal providers and are compensated whenever their trades are copied.

For every trade a signal provider places on a live trading account, the signal provider gets paid half a pip per 1 lot.

ZuluTrade main features

- Social charts

This is a feature that enables traders and followers to communicate with one another while viewing a chart.

The social chart feature resembles the picture below.

Social charts give newbies a good learning platform because they can ask the more experienced traders any questions while viewing the same chart.

- Forex Traders Lists

This is a forum-based platform provided by ZuluTrade that allows traders to communicate with one another.

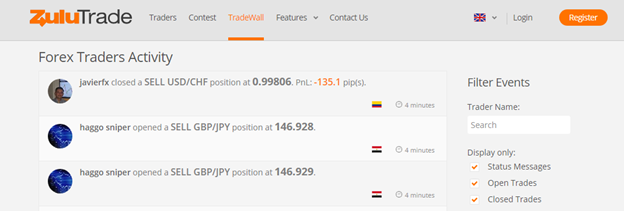

- TradeWall

This feature offers ZuluTrade users the ability to view trading activities of other traders.

- ZuluGuard

ZuluGuard is a protection feature offered by ZuluTrade and its main purpose is to protect investor funds.

It works by monitoring the behavior of every trader and it will automatically eradicate a trader whenever it detects irregularities in a trading strategy.

- Automator

This feature enables users to be able to create and automate rules. For example, ‘RULE: If a trade is in a profit of $500, set a trailing stop’.

In this example, a trailing stop loss will be automatically activated and this eliminates the need to physically monitor and manage trades.

Conclusion

ZuluTrade has bridged the gap between investors, novice traders, and professional traders.

Professional traders can easily provide signals to their followers without the need to change their trading behavior or platform.

Investors and other traders can follow professional traders and set up trading accounts that will automatically enter trades in accordance to the trade entered by the signal provider or professional trader.

Novice traders have a platform in which they can interact with professional traders and as a result become better traders.

You can read more about ZuluTrade here.

Wrapping Up

Success in the trading of currencies requires that you have a credible and reliable broker that will meet your needs without undue compulsion.

Therefore, to choose the best forex broker is important.

Before you are enticed by that attractive looking banner to open an account, you should first analyze the industry practice of the broker as outlined in this article.

Thanks for finally talking about > How to Choose the Best Forex Broker | Forex Trading Big < Liked it!

Excellent article! We are linking to this great article on our site.

Keep up the great writing.

I love what you guys are usually up too. This

type of clever work and exposure! Keep up the amazing works guys I’ve incorporated you

guys to our blogroll.

I am actually delighted to glance at this webpage posts which carries tons of useful facts, thanks

for providing these info about how to choose a forex broker.

I needed to thank you for this good read!! I

definitely loved every little bit of it. I have you book marked to check out

new things you post…

I couldn’t refrain from commenting. Perfectly written!

Hi there everyone, it’s my first pay a visit at this web site, and paragraph is genuinely fruitful for me,

keep up posting these types of posts.

What are Contracts for Differences (CFDs)? Also explain virtual money in demo accounts. What does it mean?

I appreciate the article. Thanks

Thanks for your comment. CFDs generally refers to an agreement between two parties to settle, at the close of the contract, the difference between the opening and closing prices of the contract.

And, virtual money refers to the cash the broker gives you for demo trading. You cannot withdraw the profits from virtual trading as it is meant only for reasons of practice.

Please send us a message through our contact form on this site if you need specialized assistance in creating a blog. Thanks.