The double bullish candlestick patterns are formed by two candlesticks. They are of three main types:

a) Bullish engulfing

b) Tweezer bottoms

c) Piercing pattern

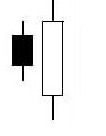

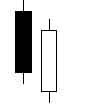

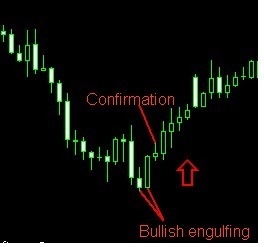

a) Bullish engulfing candlestick pattern

This pattern is considered to be a very strong indicator of reversal when it appears at the end of a downtrend.

The bullish engulfing pattern is formed by two candles wherein a bearish candle is immediately followed by a larger bullish candle.

The body of the second candle (bullish) completely “engulfs” the first candle (bearish).

And, this is an indication that the bullish pressure may soon take control of the market following a recent downtrend or a period of consolidation.

In this pattern, the shadows at the ends of the candlesticks may also be engulfed but it’s not necessary. In some cases, a doji may form the first candlestick.

It is important to note that the bullish engulfing pattern is stronger when the first candlestick has a small body and the second candlestick has a big body.

In addition, the emerging bullish power is stronger when the second candlestick swallows up more than one candlestick.

How to identify a bullish engulfing pattern

- The pattern is formed by two candlesticks having different colors

- The body of the large bullish candlestick should completely engulf the preceding small bearish candlestick.

- It appears at the end of a downtrend

When seen on a chart, the pattern may look something like this:

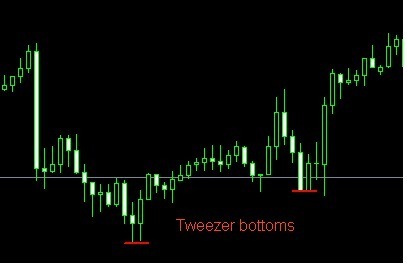

b) Tweezer bottoms

Tweezer bottoms are reversal patterns that usually appear following a prolonged downtrend. The pattern is formed from two candlesticks that are next or so close to one another, and they can have small bodies just like doji or hammer candlesticks.

Usually, tweezer bottoms have identical lows and are found at the bottom of the market.

The pattern is constituted by the candlestick shadows. In addition, it may also be constituted by the bodies of the shaven candlesticks.

The two candlesticks forming the tweezer bottoms pattern ought to have alternating colors in which the first verifies the current trend while the second suggests signs of weakness.

It is important to note that tweezer bottoms that appear around significant support levels, trend lines or pivot points are more reliable, particularly when they are composed of two doji candlesticks.

The pattern is also more reliable when it forms another pattern, for example, a bullish engulfing pattern or a piecing pattern having identical lows.

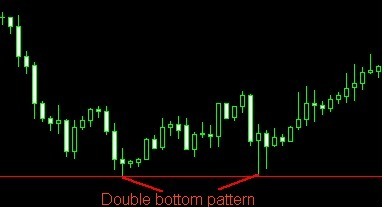

If the shadows are long, the signal generated by this pattern becomes more significant. In some cases, a few or even many candlesticks can appear between the two candlesticks that constitute the tweezer bottom pattern and form the double bottom chart pattern.

How to identify tweezer bottoms

- It appears in a downtrend

- The first candle should be the same as the immediate trend. In this case, the first candle should be bearish.

- The second candle should be opposite the immediate trend. In this case, the second candle should be bullish.

- The shadows of the candlesticks ought to be equal or nearly equal in length. The lows of tweezer bottoms ought to be the same or nearly the same.

When seen on a chart, the pattern may look something like this:

c) Piercing candlestick pattern

The piercing candlestick pattern is a bullish trend reversal pattern formed by two candlesticks.

The pattern appears towards the end of a downtrend and it is the opposite of the dark cloud cover pattern that appears towards the end of an uptrend.

Basically, the piecing candlestick pattern is formed when the second candlestick closes above the midpoint of the real body of the first candlestick.

It is of essence to note that the deeper it pierces the first candlestick, the more reliable the pattern becomes.

In addition, the pattern becomes more reliable if the two candlesticks that constitute the pattern are marubozu candlesticks having no upper or lower shadows.

Just like any other candlestick reversal pattern, the piercing pattern has more weight when it appears around trend lines, pivot points, or support and resistance zones.

As an example, a piercing pattern that forms close to or near a lower trend line or support line can be used as verification that price is likely to reverse at these levels.

How to identify a piercing candlestick pattern

- It appears in a declining market

- It is formed by two candlesticks in which the first is a bearish candlestick and the second is a bullish candlestick

- The bullish candlestick should close above the middle of the real body of the first candlestick

When seen on a chart, the pattern may look something like this:

When seen on a chart, the pattern may look something like this:

Summary

The three main types of double bullish candlestick patterns are bullish engulfing, tweezer bottoms, and piercing pattern.

These candlestick patterns mostly appear at the end of a downtrend, indicating that an uptrend is imminent.

Before entering trades based on the analysis of these patterns, it is important that you confirm your trading decision by using indicators, other chart patterns, support and resistance levels, fundamentals etc.

Very vigorous post, I liked that a lot. Will there be a chapter two?

Yes, the post is in fact a continuation of a series of articles on “candlestick chart patterns”. Thanks for your comment.

I don’t even know how I ended up right here, however I believed this post used to

be good. I don’t recognize who you’re but definitely you’re going to a well-known blogger should you

are not already. Cheers!

Hey there just wanted to give you a quick heads up and let you

know a few of the images aren’t loading correctly. I’m not sure why but

I think its a linking issue. I’ve tried it in two different browsers and both show the same outcome.

Thanks for letting us know. We are working on that.

You really make it apear soo easy with your presentation but I to find this topic to be really one thing which I feel I might never understand.

It sort of feels too complex and extremely broad for me. I am having a look ahead to

your subsequent put up, I’ll attempt to get the dangle of it!

Herre is my weblog how to trade forex options

Thank you for sharing your thoughts. I truly appreciate your efforts and

I will be waiting for your further post thanks once again.

Excellent beat ! I wish to apprentice at the same time as

you amend your website, how could i subscribe for a weblog web

site? The account helped me a applicable deal.

I had been a little bit acquainted of this your broadcast offered bright clear concept

I recommend all Forex Traders to read this article. Without the knowledge of double bullish candlestick pattern, it becomes hard to succeed.