The triple bullish candlestick patterns are formed by three candlesticks. Generally, they are bullish reversal patterns.

They are of four main types:

a) Morning star

b) Bullish abandoned baby

c) Three advancing white soldiers

d) Three inside up

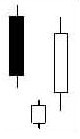

a) Morning star candlestick pattern

The morning star is a strong reversal pattern that is found at the bottom of a downtrend. Just like the morning star, the planet Mercury, it predicts the sunrise, or the imminent rising prices.

The morning star consists of three candlesticks with the middle candle forming a star

- The first candlestick should be a bearish candlestick. And, its body should be of considerable size.

- The second candlestick should have a small body. As such, it signifies that there could be some indecision in the market. This candlestick should be either bearish or bullish. In reality, morning star is the second candlestick. Nonetheless, the other candlesticks must appear for the morning star pattern to be relevant.

- The third candlestick should be a bullish candlestick. It verifies that a reversal has indeed occurred, since it closes beyond the midpoint of the first candlestick.

It is worth mentioning that the gap between the real bodies of the two candlesticks differentiates a morning star from a doji or a spinning bottom.

Also, the second candlestick does not need to appear below the low of the first candlestick and can appear within the lower shadow of that candlestick.

When seen on a chart, the pattern may look something like this:

Important notes

For a morning star pattern to be more reliable in giving reversal signals, it should have the following qualities:

- The third candlestick should open above the real body of the second candlestick leaving a gap between the real bodies of the second candlestick and the third candlestick. The bigger the gap, the more reliable the signal becomes.

- The real body of the third candlestick should considerably pierce the real body of the first candlestick, particularly if the third candlestick has little or no upper shadow.

- The third candlestick should have a higher trading volume that the first candlestick.

b) Bullish abandoned baby

At times, the morning star (the second candlestick) is a very small candlestick with small or no shadows and the gap is so large that even none of the candlesticks shadows cover any section of it.

This pattern is referred to as the bullish abandoned baby. Essentially, it is quick shift in momentum from the bears to the bulls in which the former is caught off guard.

Due to the high volatility of the foreign exchange market, this pattern is very rare and it may just appear in larger time frames. However, when it appears on a chart, it is a very strong reversal signal.

The bullish abandoned baby has the following characteristics:

- It appears towards the end of a downtrend

- The first candlestick is bearish

- The second candlestick is a doji whose shadows gap below the lower shadow of the previous candlestick and also gaps in the direction of the previous trend

- The third candlestick is bullish and it gaps in the opposite direction while having no overlapping shadows

|

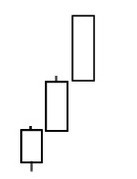

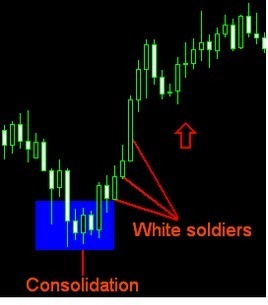

c) Three advancing white soldiers

This pattern is formed when three long bullish candlesticks follow a downtrend, giving indications that a change in trend has taken place.

The three advancing white soldiers candlestick pattern is regarded as one of the most important bullish signals, particularly if it appears after an extended downtrend and a short period of consolidation.

It is referred to as three advancing white soldiers because it has three relatively long bullish (advancing) candlesticks that signal the end of a downtrend or suggests that the period of consolidation after the downtrend is finished.

The following are the conditions that must be met for the three advancing white soldiers pattern to be considered valid:

- Every one of the three candlesticks ought to close on or near the high price for the period with every candlestick making steady rise in price.

- Every one of the three candlesticks ought not to have long upper shadows or wicks and ought to possibly open within the real body of the preceding candlestick in the pattern. Nonetheless, the latter is not very important.

When seen on a chart, the pattern may look something like this:

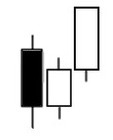

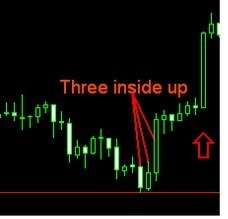

d) Three inside up

This pattern is formed by three candlesticks at the bottom of a downtrend. The three inside up pattern signals an imminent change in the trend of the market to the upside.

The following are the conditions that must be met for the three inside up pattern to be considered valid:

- The first candlestick ought to appear at the bottom of a downtrend. In addition, it ought to be a long bearish candlestick.

- The second candlestick ought to close above or next to the midpoint of the first candlestick.

- The third candlestick ought to close above the high of the first candlestick. And, this verifies that the emerging bullish pressure has overwhelmed the strength of the downtrend.

When seen on a chart, the pattern may look something like this:

Summary

Morning star, bullish abandoned baby, three advancing white soldiers, and three inside up are the four main types of triple bullish candlestick patterns.

If you know how to identify them when trading currencies, then you can reap big profits in this business.

Good content bigtrader! I will come back for more Forex Trading information.