Support and resistance are undoubtedly one of the most used concepts in forex trading. Particularly, technical analysis in forex trading is centered on identifying support and resistance levels.

In general, support and resistance are terms used by traders to refer to price levels on charts that tend to act as obstacles to stop the price of a currency pair from getting pushed in a certain direction.

Support can be defined as a certain price level that depicts considerable ability to hold the price of a currency pair above. In other words, it can be said to be the floor that acts as the barrier for the price.

Resistance can be defined as a certain price level that depicts considerable ability to hold the price of a currency pair below. In other words, it can be said to be the ceiling that acts as the barrier for the price.

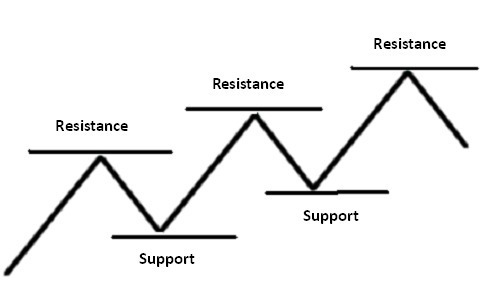

The following diagram is a basic representation of support and resistance levels: The above diagram is an example of a market in an uptrend. Generally, the market is whipsawing back and forth as it moves up.

The above diagram is an example of a market in an uptrend. Generally, the market is whipsawing back and forth as it moves up.

The highest level it reaches before receding is the resistance level. And, as the market goes on with its upside move, the lowest level it reaches before moving up again is the support level.

Thus, this is how resistance and support levels are constantly being formed as the market fluctuates. For a market in a downtrend, the opposite is true.

It is important to note that support and resistance levels become more valid in a trending market; that is, either in a downtrend or in an uptrend. When plotted in a ranging market, they may not become very significant.

How to draw support and resistance levels

It is of essence to note that support and resistance levels should not be considered as exact numbers. You should think of these levels as “regions” and not exact price levels.

To plot support and resistance levels on a chart, look for places where the market has been rejected and connect them with a line.

For support levels, look for places that tend to hold the market above them and for resistance levels, look for places that tend to hold the market below them.

How to trade forex using support and resistance

There are several methods you can use for trading forex using support and resistance. The two most common ones are:

i. Trade the bounce off the support or the resistance level

ii. Trade the breakout from the support or the resistance level

The first method involves placing trades when price fails to break through a support or a resistance area.

When a support or resistance area is respected by the market, price may experience a pull back and this can give you an opportunity to enter a trade.

The best instance to use this method is when the market is ranging. Basically, in a ranging market, price is confined within significant support and resistance levels.

As such, you may place an order when price touches either of the levels.

The second method involves placing trades when price convincingly breaks through a support or a resistance area.

When that level has been strong, the break out will be more strong. This often occurs when the break out takes place after periods of price consolidation.

The following example is about a broken support level:

Important note

You should be wary of false breakouts; that is, resistance and support levels that appear broken, but in real sense the market was just testing them.

It is important to note that these false breakouts are often represented in candlestick charts by the candlestick shadows.

A picture talks more than a 1000 words:

In the diagram above, the shadows of the candlesticks broke past the support but they ended up closing above it.

You could be tempted to think that the market was “breaking” past the support. However, in reality, the market was just testing the level and it lacked enough bearish strength to break past it.

How to avoid false breakouts

It is not easy to avoid false breakouts when plotting support and resistance levels.

Some technical analysts say that support and resistance levels are broken if the price of a currency pair manages to close past that level. Regrettably, we have learnt that this is not always true.

For example, in the diagram above, price managed to close below the support level; however, it soon took the opposite direction and sailed past the previously broken support level.

If you thought that the support level was broken and placed a short order, you could have done a lot of damage to your trading account.

If you see the chart now, you can see that this was another case of false breakout as the support level stayed and continued to hold the price above it.

Therefore, to assist you avoid such false breakouts, you should consider support and resistance as “regions” and not as actual numbers.

Over time, we have learnt that when support and resistance levels are plotted on a line chart instead of a candlestick chart, they become more helpful in finding these zones. Could you guess the reason why?

As it was discussed in this article, (click to be redirected) line charts only give the closing price whereas candlesticks add the extreme highs and lows to the behavior of a currency pair.

These highs and lows given by the candlestick charts may not be very accurate, as in most cases they are just the “knee-jerk” reactions being experienced in the forex market.

And, when drawing support and resistance levels, you do not want these excessive reactions. Your aim is to capture only the intentional movements taking place in the marketplace.

As illustrated in the diagram below, you can draw the support and resistance levels on a line chart around places where the market seems to be making peaks or valleys.

6 golden rules about support and resistance

- When price passes through resistance, that level is likely to become support. And, the reverse is also true.

- The more the rejection of a resistance or a support level, the stronger that particular area becomes.

- The stronger the support or the resistance level, the stronger the follow-through move when that area is convincingly broken.

- Price needs to be rejected more than once from the level of support or resistance. Not that it is not once, but at least twice.

- The most recent rejections carry more weight than the less recent rejections.

- Just like any other strategy, support and resistance should not be used in isolation when trading forex. They should be combined with other strategies such as candlestick analysis, chart patterns etc.

What a wonderful message! Am going to use support and resistance under the rules highlighted here. I was wondering whether you know any site providing information like this one. Please help me.